Ethical Investment Portfolios

Shariah-compliant, value-driven investment options designed to help clients grow wealth responsibly while avoiding prohibited or harmful industries.

Founded in 2025 with 100% Nigerian ownership, Ethica Capital is a forward-thinking non-interest financial services firm. Grounded in Shariah principles and moral responsibility, we are committed to helping individuals and institutions grow wealth ethically.

We believe true prosperity goes beyond numbers — it’s about integrity, values, and purpose. Every product and service we offer adheres strictly to Islamic financial principles, enabling our clients to invest, save, and plan for the future without compromising their beliefs.

To provide ethical, Shariah-compliant investment and financial planning solutions that uphold moral values, protect capital, and promote long-term financial security and dignity for our clients.

To be a trusted leader in non-interest financial services, empowering individuals and institutions to build, preserve, and transfer wealth responsibly through principled and transparent financial practices.

Ethical investment solutions guided by Islamic finance principles, ensuring transparency, fairness, and responsible wealth creation.

Channeling capital into halal opportunities that support real economic activity and long-term value creation.

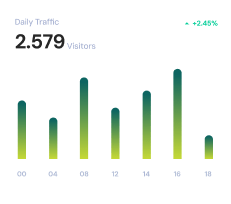

Helping you stay on track with well-defined investment structures, accurate projections, and disciplined portfolio management.

Building resilient portfolios designed for stability, impact, and long-term success across market cycles.

We are committed to making Shariah-compliant financial solutions accessible to a broader range of individuals and institutions, ensuring ethical finance is inclusive, practical, and impactful.

Ethica develops forward-thinking Islamic financial products designed to meet modern financial needs while remaining firmly rooted in Shariah principles and best practices.

Our investment strategies are structured to deliver strong, sustainable returns without compromising ethical standards, balancing profitability with responsibility in today’s financial landscape.

DThrough strategic partnerships and a robust distribution network, we extend our reach, strengthen market presence, and deliver value efficiently across key markets.

We believe ethical investing should be transparent and easy to understand. Below are answers to some of the most common questions about Ethica Capital, our Shariah-compliant approach, and how we deliver responsible financial solutions.

Shariah-compliant investing at Ethica Capital means all products and activities adhere strictly to Islamic principles. This includes avoiding interest (riba), excessive uncertainty (gharar), unethical industries, and ensuring investments are backed by real economic activity and ethical considerations

Our solutions are designed for individuals, institutions, corporates, and high-net-worth investors seeking ethical, Shariah-compliant investment opportunities. We also collaborate with partners and distributors to broaden access across different markets.

Ethica Capital offers a range of Islamic financial and asset management solutions, including structured investment products, savings and investment vehicles, and bespoke Shariah-compliant portfolios tailored to client needs.

All products and services are developed and reviewed in line with established Shariah standards. Ethica Capital works with qualified scholars and governance frameworks to ensure continuous compliance throughout the product lifecycle.

Yes. Ethica Capital is committed to delivering competitive returns while maintaining strong ethical standards. Our investment strategies are designed to balance risk, sustainability, and profitability within the Islamic finance framework.